Child Tax Credit 2024 Increase Percentage – House lawmakers have advanced a $78 billion bipartisan tax package, which includes pivotal changes to the child tax credit for the 2023 filing season. As tax season looms, the proposed adjustments aim . The framework suggests increasing the maximum refundable portion of the CTC from the current $1,600 per child Tax Credit will build more than 200,000 new affordable housing units.” The changes .

Child Tax Credit 2024 Increase Percentage

Source : www.forbes.com

States are Boosting Economic Security with Child Tax Credits in

Source : itep.org

IRS Announces 2024 Tax Brackets, Standard Deductions And Other

Source : www.forbes.com

States are Boosting Economic Security with Child Tax Credits in

Source : itep.org

Your First Look At 2024 Tax Rates: Projected Brackets, Standard

Source : www.forbes.com

States are Boosting Economic Security with Child Tax Credits in

Source : itep.org

Child Tax Credit Definition: How It Works and How to Claim It

Source : www.investopedia.com

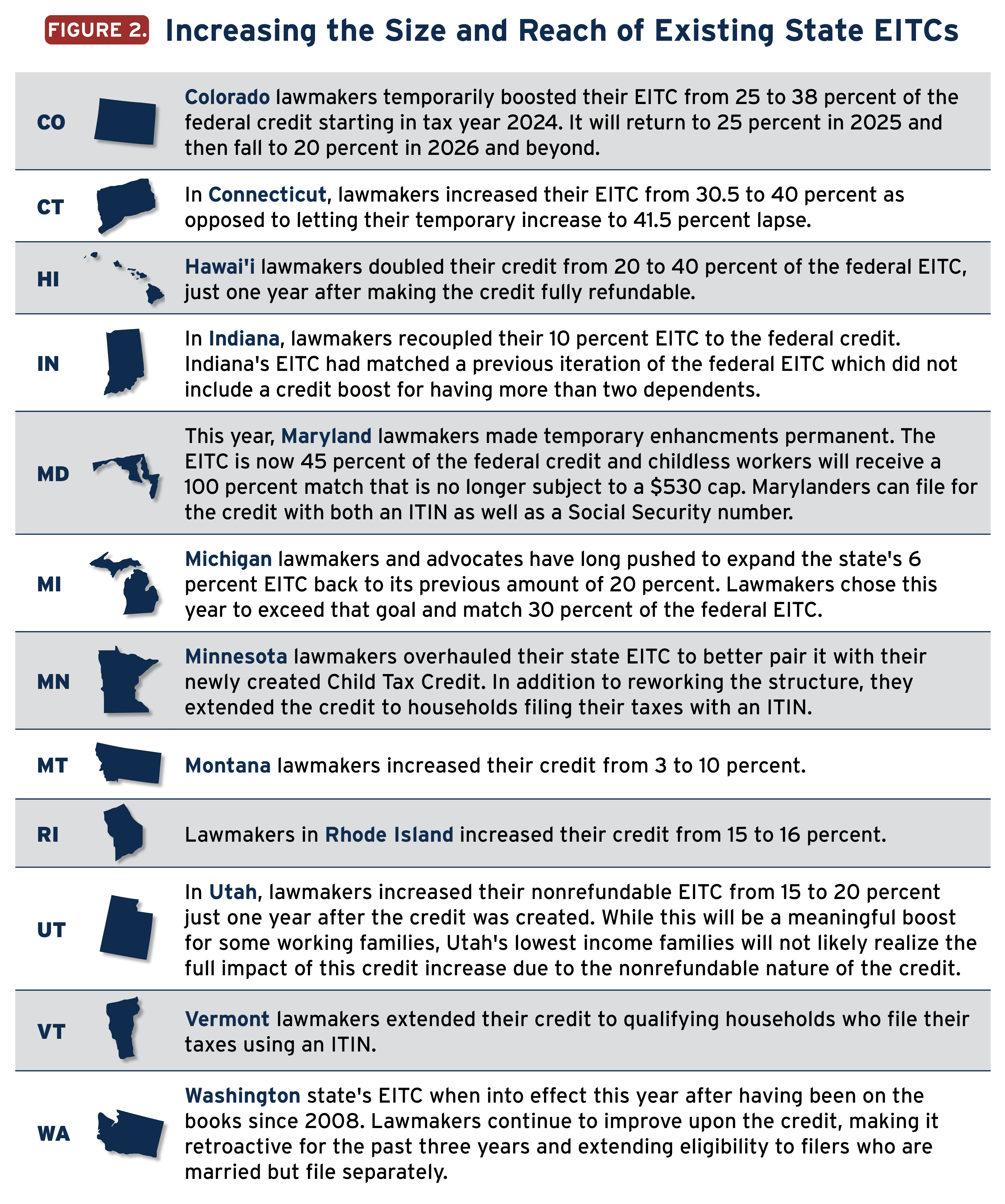

Boosting Incomes, Improving Equity: State Earned Income Tax

Source : itep.org

Bipartisan deal to expand child tax credit, revive business tax

Source : nebraskaexaminer.com

IRS Announces 2024 Tax Brackets, Standard Deductions And Other

Source : www.forbes.com

Child Tax Credit 2024 Increase Percentage Your First Look At 2024 Tax Rates: Projected Brackets, Standard : This entails multiplying earned income exceeding $2,500 by 15 percent, then multiplying credit amount is slated to increase to $1,800 for 2023, $1,900 for 2024, and $2,000 for 2025. The overall . Child Tax Credit 2024 Eligibility A recent legislative change nevertheless facilitated the provision of desperately required relief. Beginning with the 2023 tax year, which is due in 2024, .

:max_bytes(150000):strip_icc()/child-tax-credit-4199453-1-7dd01914195e4ab2bc05ae78a40f8f0c.jpg)